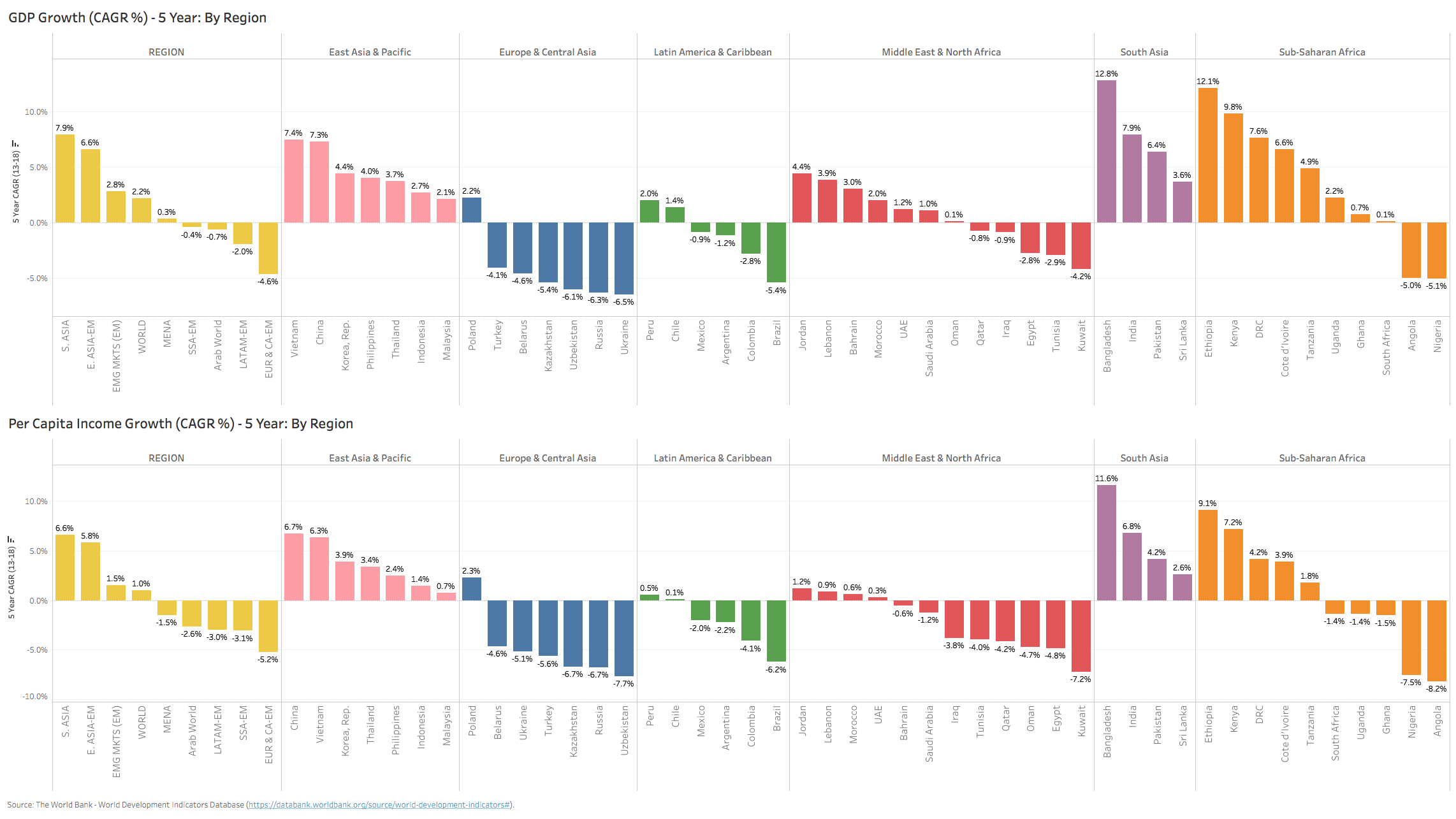

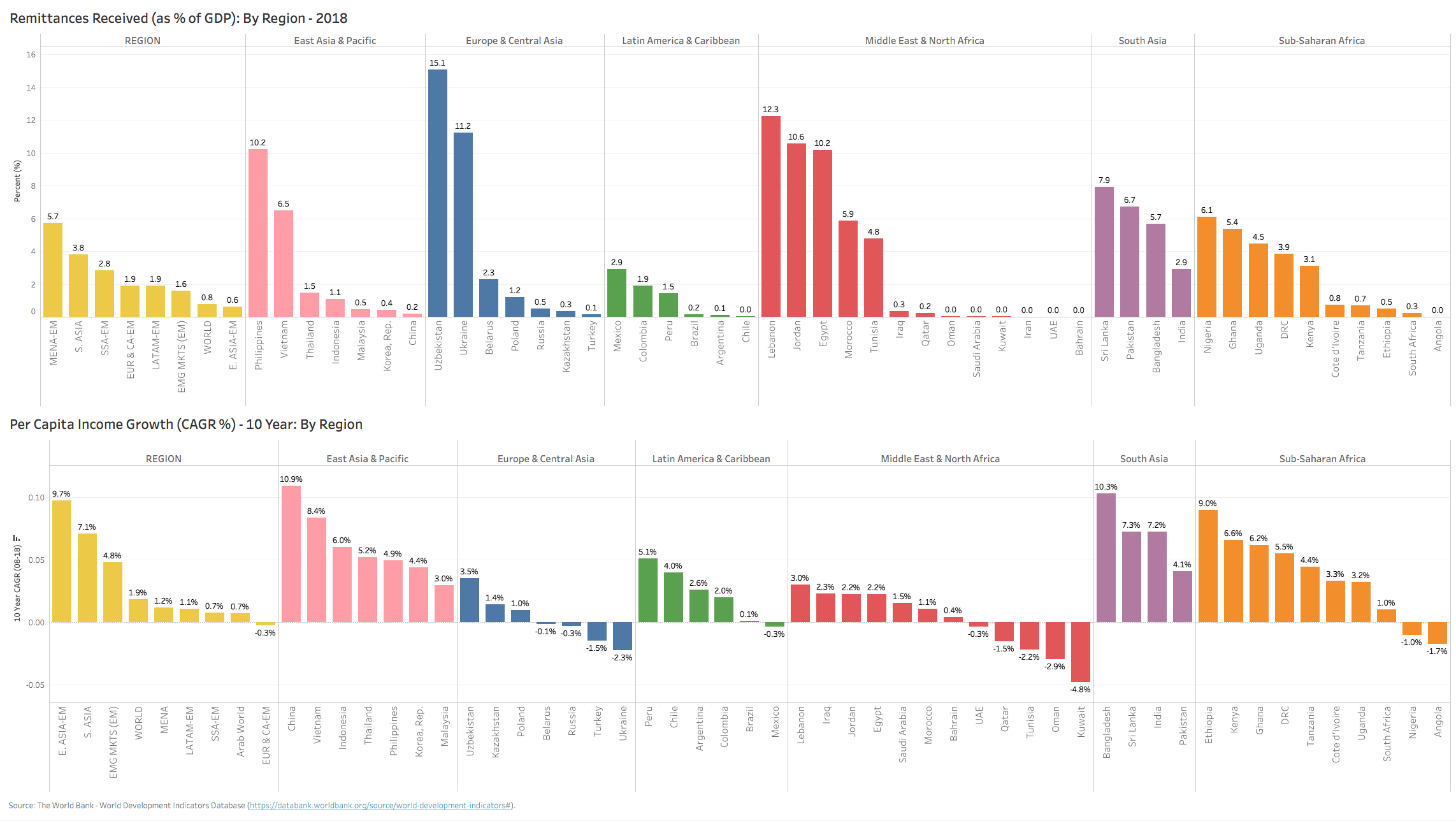

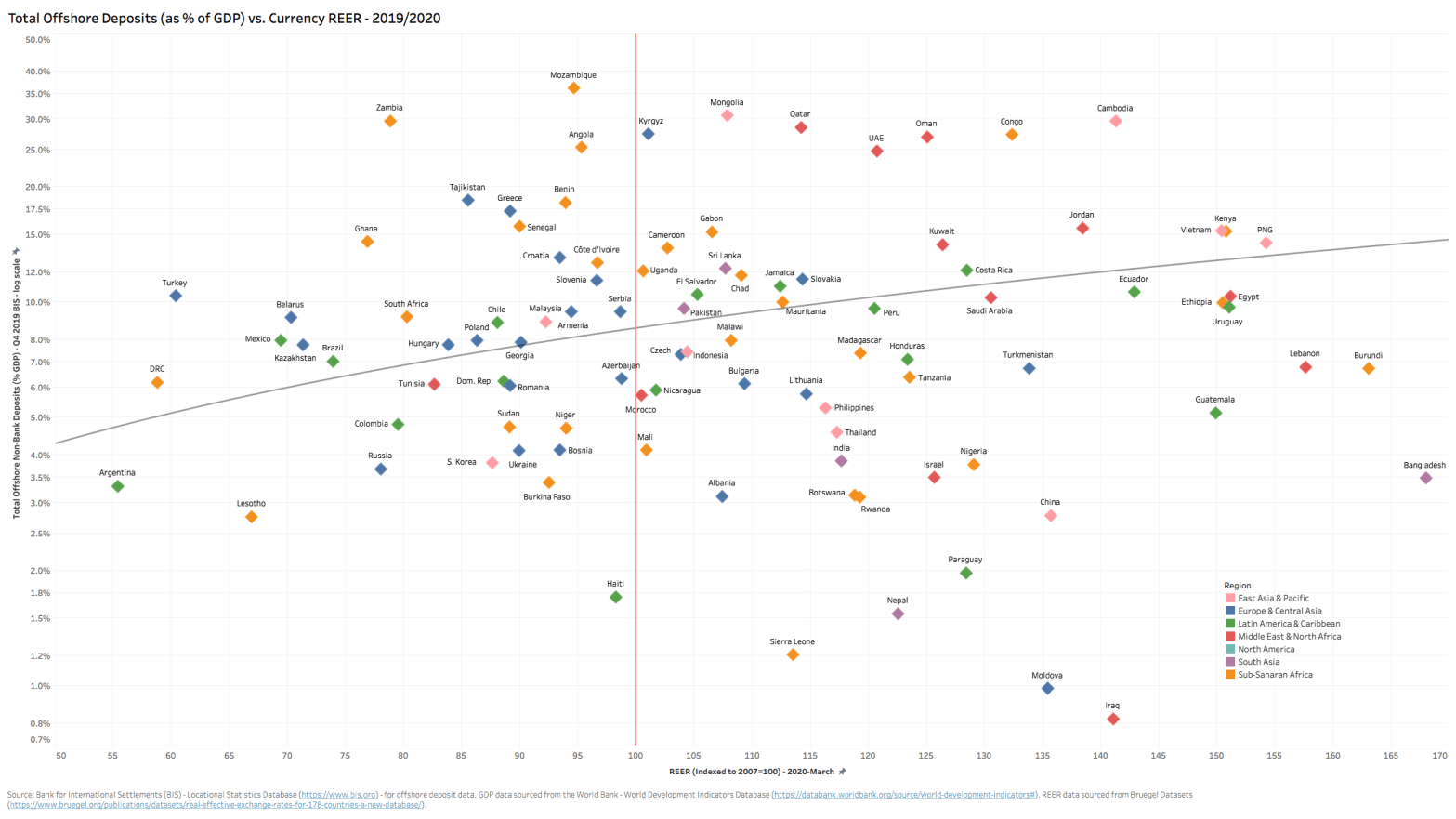

Here is a dangerous cocktail: a) chronic dependency on either foreign aid, inbound remittances or resource rents (or all of the above) and b) a dangerously overvalued exchange rate that is (in most cases) artificially pegged to the all-mighty, yet inflated US dollar.

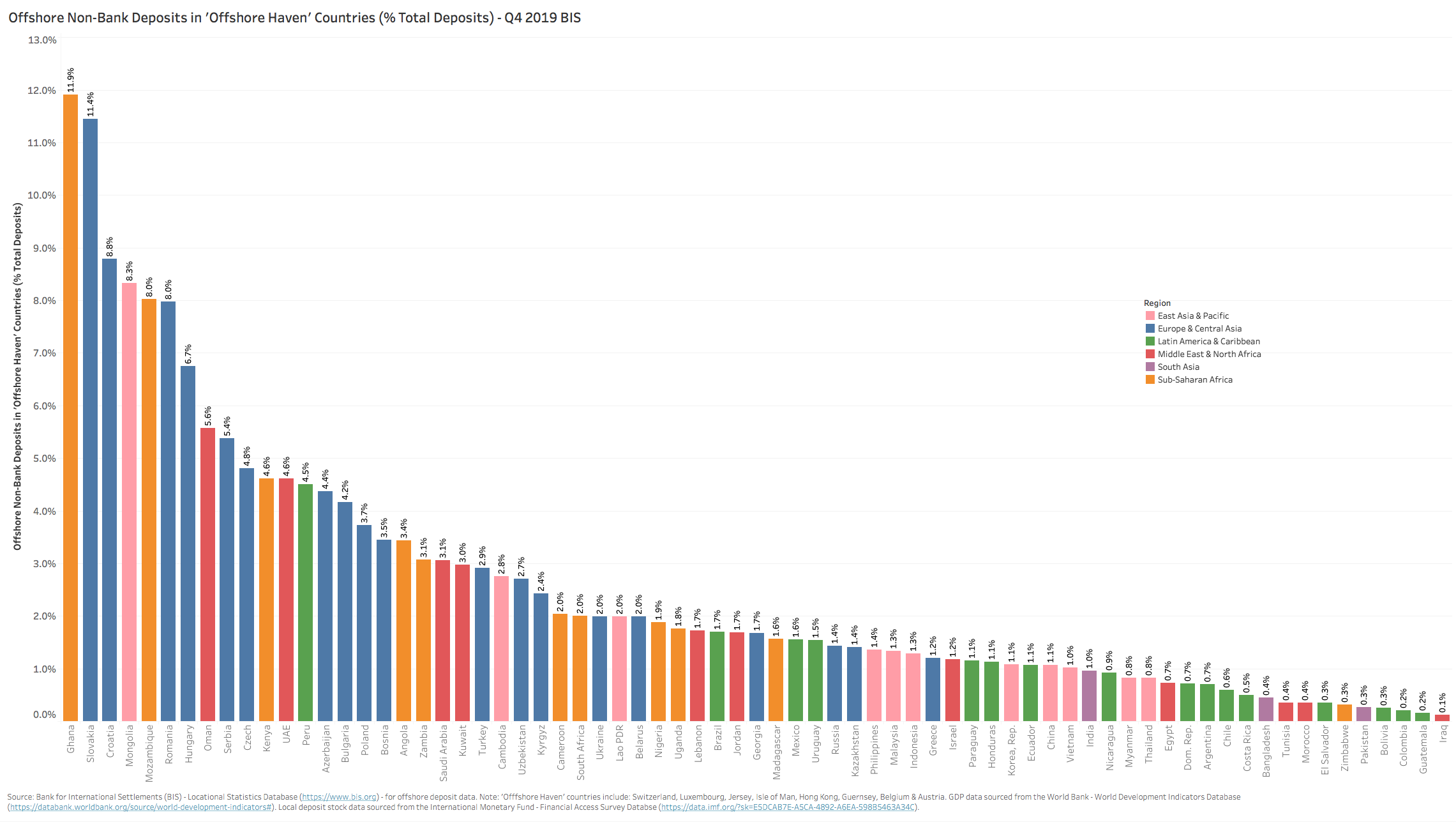

One of the not-so-obvious consequences of this toxic brew is an acceleration in capital flight or ‘offshoring’ of deposits (in terms of both aggregate stock of offshore deposits & their share relative to domestic deposits or GDP).

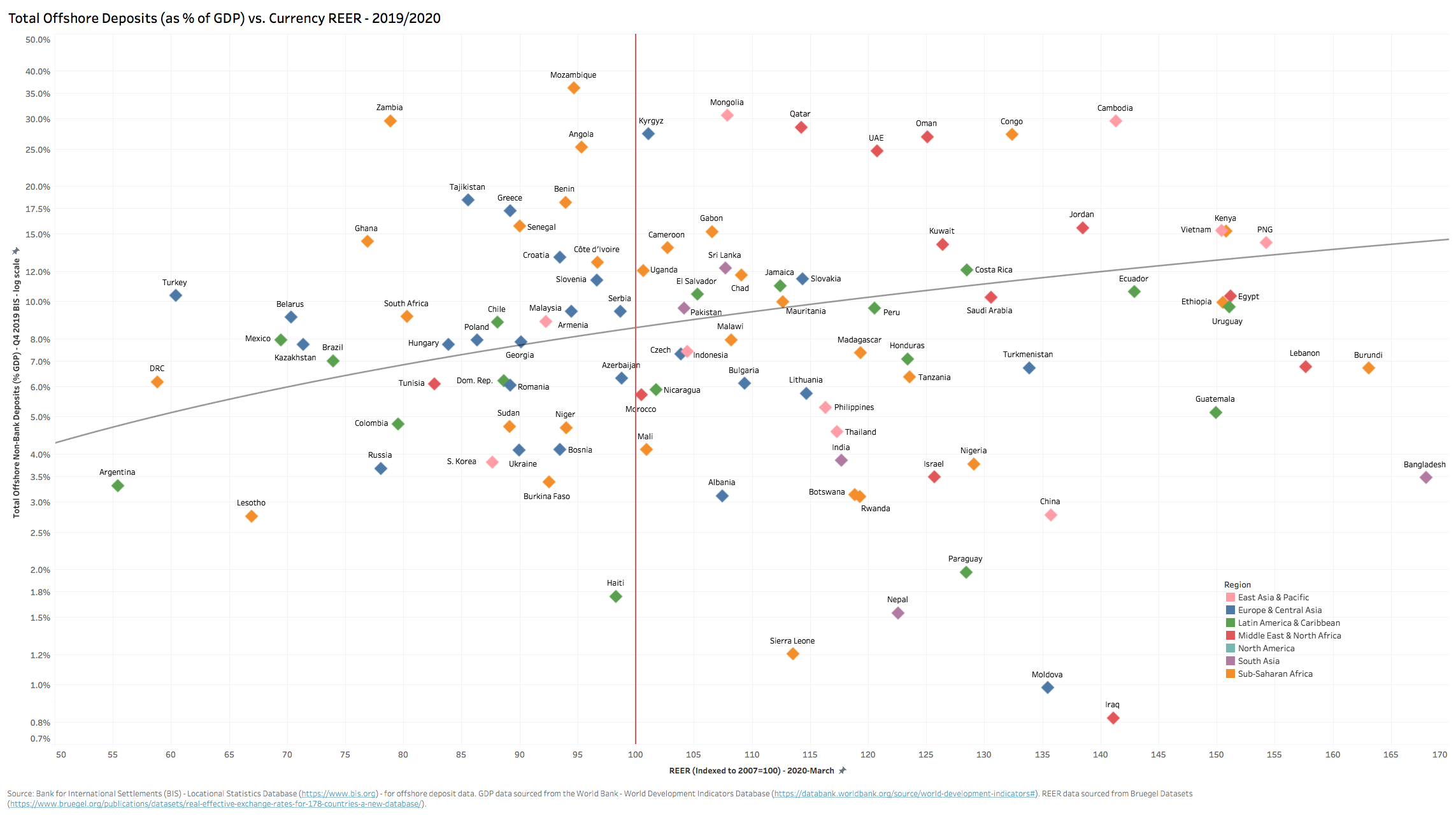

We recently came across a World Bank report on offshore deposit trends amongst high foreign aid recipient countries in the developing world (see: https://lnkd.in/deXEGmg). It is unclear to us from the report that merely a high dependency on aid in fact leads to ‘elite capture’ via ‘Haven’ offshore accounts (the causality evidence is rather weak). However, once you broaden out the variables, the empirical evidence does point to an accelerating trend in offshore deposit share for countries that have several of the above characteristics, with the common anchoring element of an overvalued exchange rate (measured in terms of REER). This is especially the case if capital is actually still able to flee unencumbered (i.e. no capital controls, financial/economic sanctions, etc.).

Several MENA & Sub-Saharan African countries stand out in this regard, with both resource rich and resource poor countries ticking too many of these boxes.

Frogs in slowly boiling water.

Note to readers: Right click chart and open in a new window for an enlarged version.