Looking at the current return on capital profiles for the GCC countries, a few things become abundantly clear: 1) overall GCC aggregate return on capital (7.5%) is now firmly below the blended cost of capital (7.7%), suggesting that based on the latest quarter performance, the GCC in aggregate is generating negative economic value-added, 2) withContinue reading “GCC SOE Dominance: Misalignment of Incentives and Economic Value Destruction”

Category Archives: Governance

Iraq – Tragedy to Catharsis?

Note to Readers: For a better viewing of charts, please right click the chart image and open as a new window to view in full resolution. “Iraq reminds me of a classic Shakespearean tragedy – whenever you think things just can’t get any worse, the plot surprises you by taking yet another major step down.”Continue reading “Iraq – Tragedy to Catharsis?”

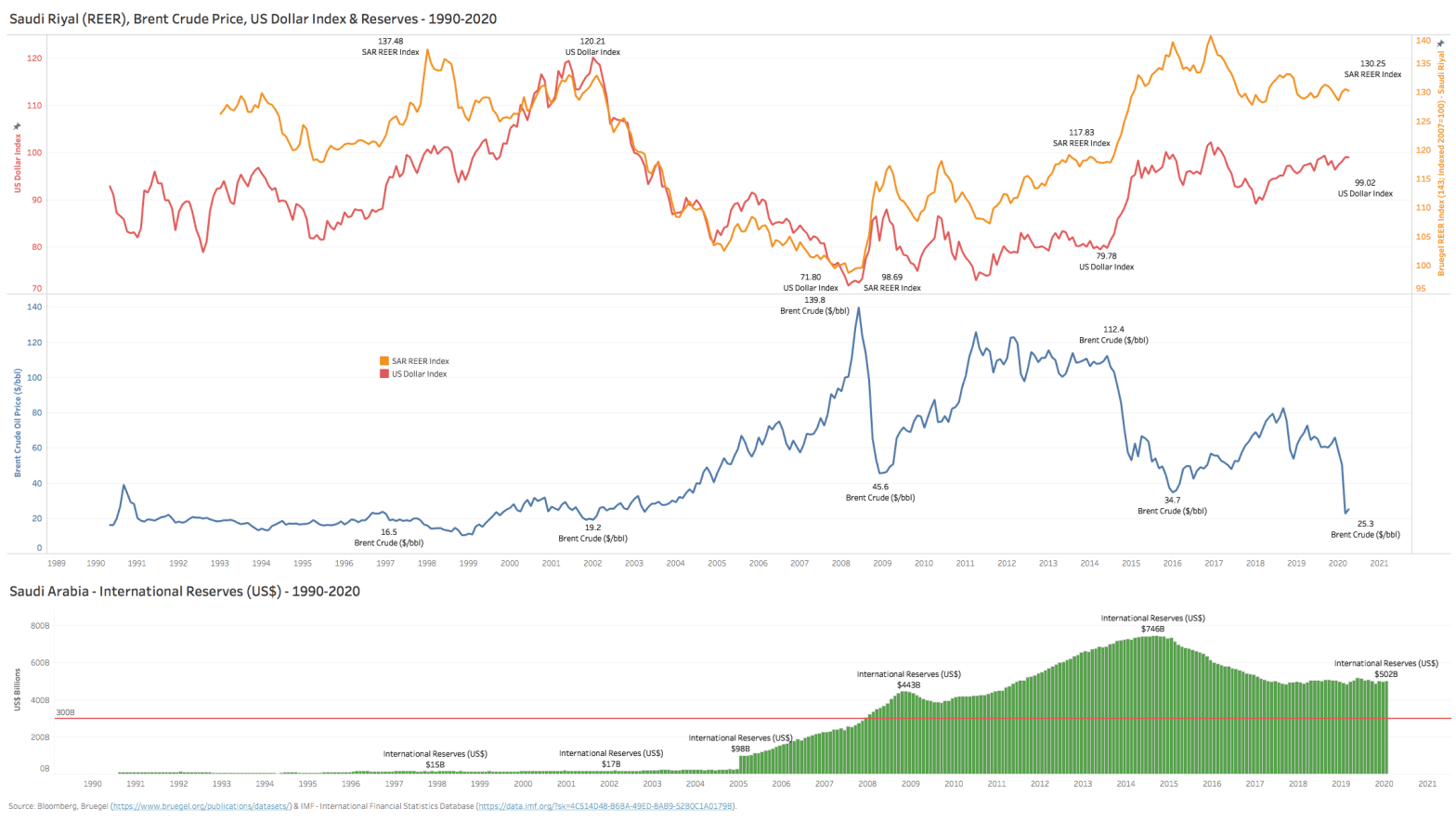

GCC – Hello Negative Operating Leverage – Can/Should GCC Pegs Persist?

The last few times GCC pegged currencies like the Saudi Arabian Riyal (SAR) were this dislocated, they were ‘saved’ by a reversal in oil prices or the US$ (or both). Time will tell if history repeats itself. One thing is for sure though – the current environment is not a great cocktail for the SAR/$ pegContinue reading “GCC – Hello Negative Operating Leverage – Can/Should GCC Pegs Persist?”

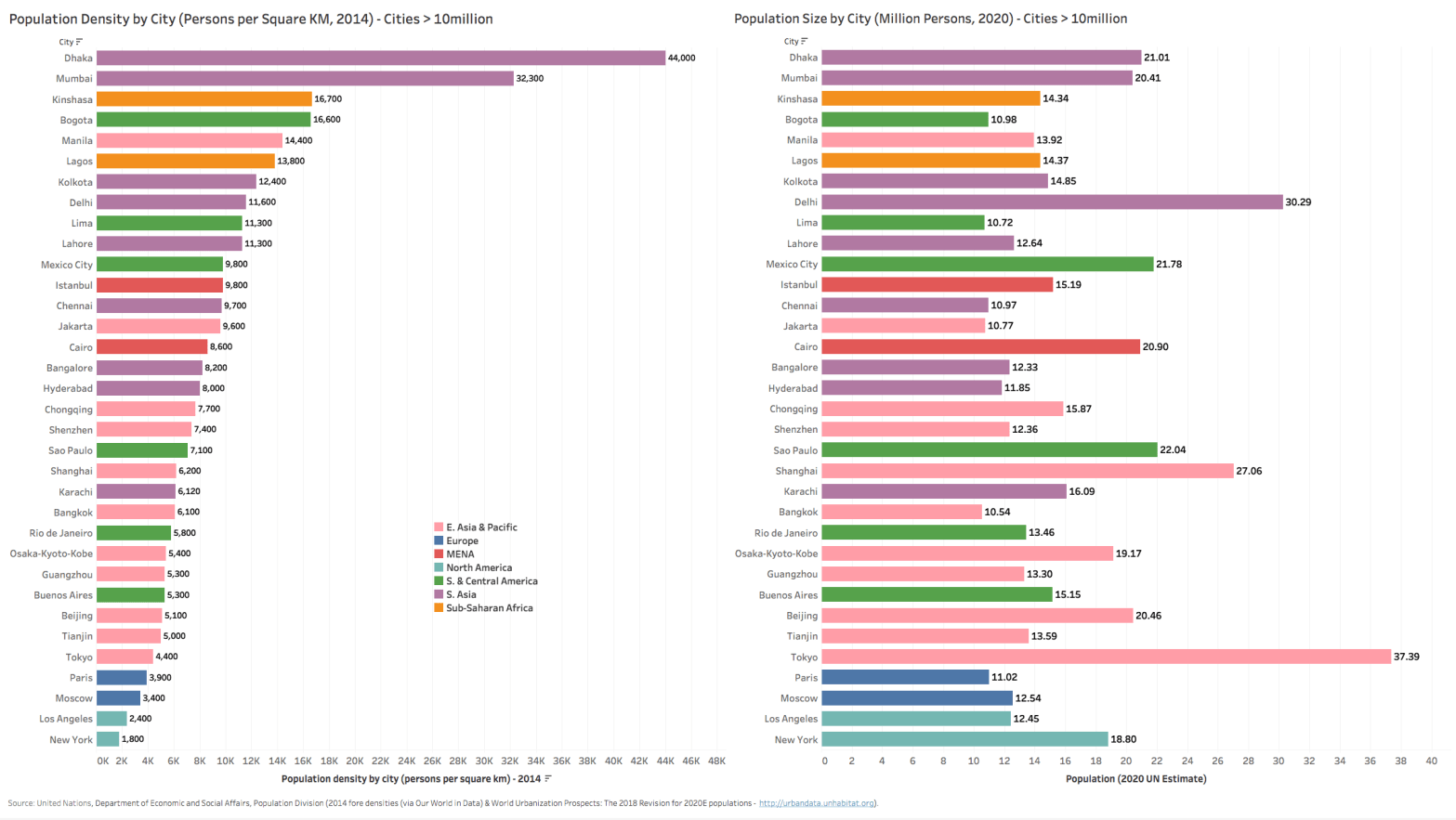

Density, Openness and Infrastructure – Emerging Market Urban City Vulnerabilities

A ranking of population densities of major urban cities worldwide (UN data for city centers with populations > 7 million) sheds some light on which major cities will need to urgently address some of the challenges of contagion presented by the ongoing COVID-19 pandemic. While most of the press focus has been mainly on developedContinue reading “Density, Openness and Infrastructure – Emerging Market Urban City Vulnerabilities”