Looking at the current return on capital profiles for the GCC countries, a few things become abundantly clear: 1) overall GCC aggregate return on capital (7.5%) is now firmly below the blended cost of capital (7.7%), suggesting that based on the latest quarter performance, the GCC in aggregate is generating negative economic value-added, 2) withContinue reading “GCC SOE Dominance: Misalignment of Incentives and Economic Value Destruction”

Category Archives: Uncategorized

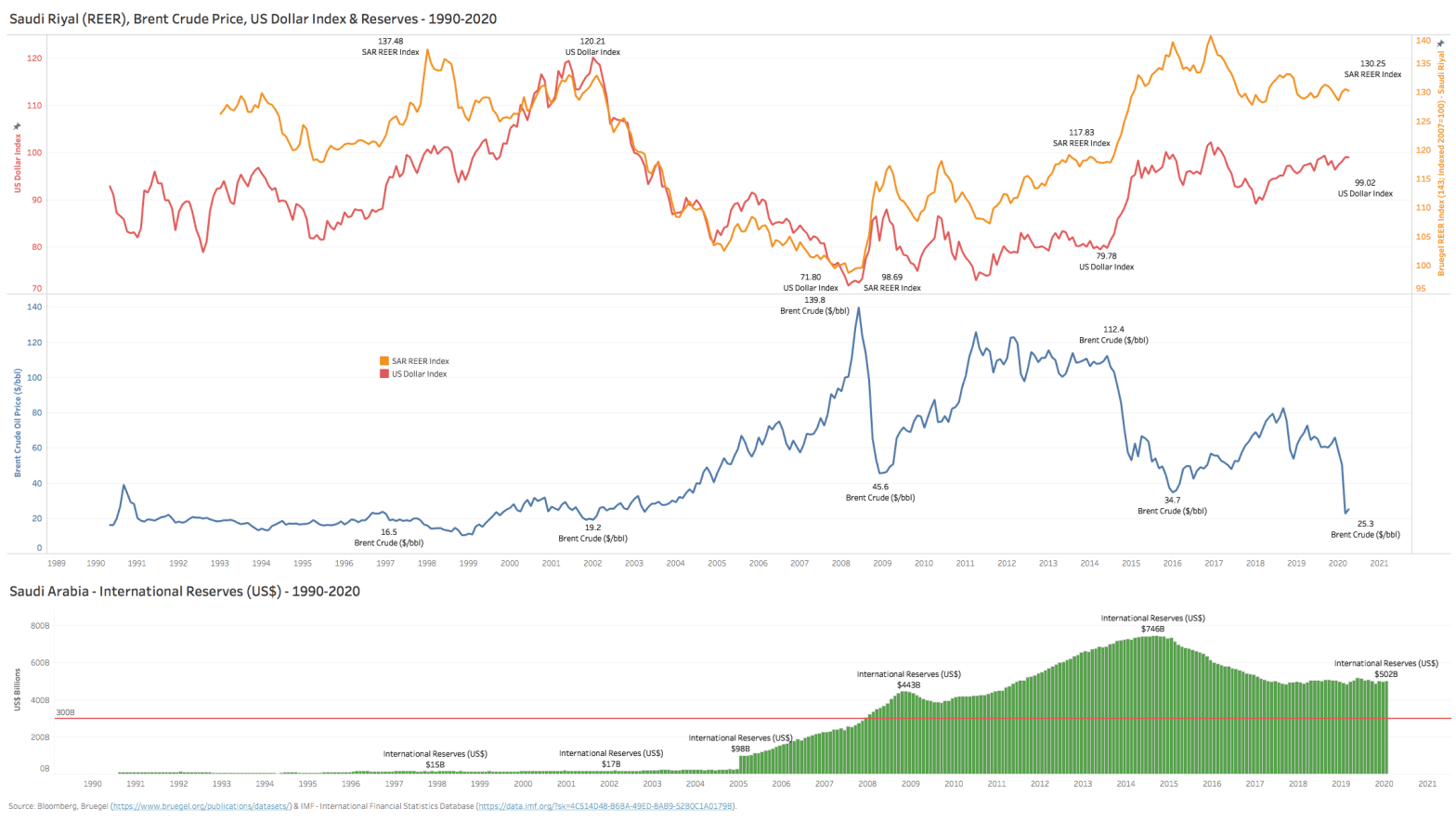

GCC – Hello Negative Operating Leverage – Can/Should GCC Pegs Persist?

The last few times GCC pegged currencies like the Saudi Arabian Riyal (SAR) were this dislocated, they were ‘saved’ by a reversal in oil prices or the US$ (or both). Time will tell if history repeats itself. One thing is for sure though – the current environment is not a great cocktail for the SAR/$ pegContinue reading “GCC – Hello Negative Operating Leverage – Can/Should GCC Pegs Persist?”

If we viewed a country through the prism of a publicly listed company – would you invest in its stock?

Note to Readers: For a better viewing of charts, please right click the chart image and open as a new window to view in full resolution. At Jadara Capital Partners, when investing across emerging and frontier markets, we spend as much time analyzing countries as we do analyzing sectors and companies. In emerging market investing,Continue reading “If we viewed a country through the prism of a publicly listed company – would you invest in its stock?”

Ukraine – A Global Powerhouse Protein Exporter in the Making

In a relatively short period (the last 10 years), Ukraine has begun to make its mark in the top rankings of major poultry exporters. The country, historically known as the ‘breadbasket of Europe’, with over a quarter of the world’s fertile chernozem soil (or “black earth”) and 54% of its land arable, has long dominated several grainContinue reading “Ukraine – A Global Powerhouse Protein Exporter in the Making”

Who will feed the world in the next decades? Part I

Looking at the sources and consumers of food by country from ’40k feet’, it is clear where the scalable and sustainable food supply will come from and where it is needed most. The first chart below segments countries by the ratio of the value of food & meat exports per capita relative to imports per capitaContinue reading “Who will feed the world in the next decades? Part I”

Who will feed the world in the next decades? Part II

The ‘haves’ and the ‘have nots’ of #foodsecurity can also be classified by abundance (or scarcity) of the two essential inputs to farming and crop cultivation – arable land and renewable water resources. You either have them or you don’t . If we look at these vital resources in terms of per capita endowments, then the classificationContinue reading “Who will feed the world in the next decades? Part II”

Who will feed the world in the next decades? Part III

Looking at the cross section of food consumption & production trends with global food trade reveals some interesting insights, particularly for the MENA region. 1. MENA countries dominate the list of top per capita wheat consumers globally (11 of the top 20), with several still growing consumption at far higher rates than the world average. EgyptContinue reading “Who will feed the world in the next decades? Part III”

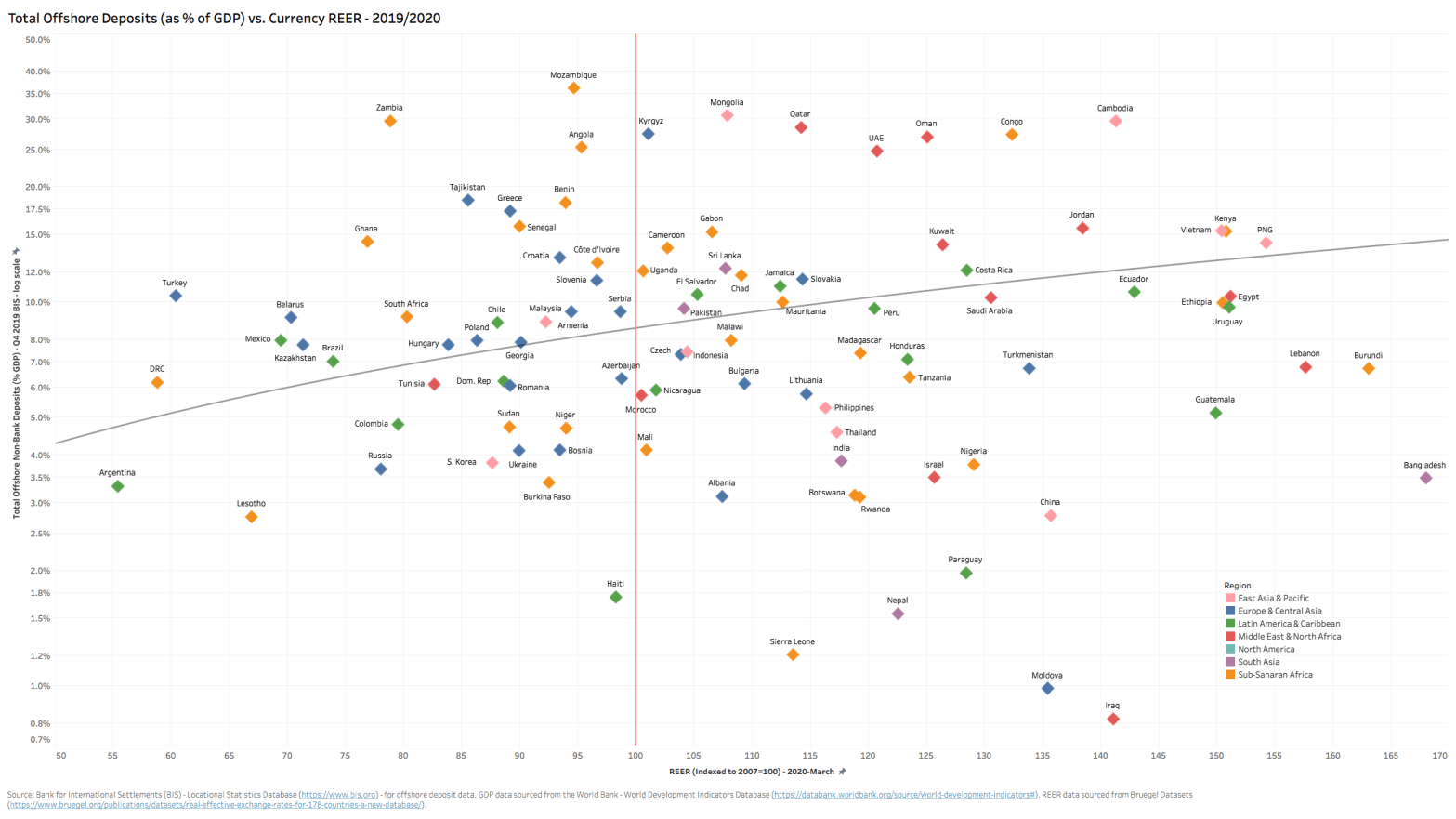

Aid, Rents, Remittances and Pegs – A Toxic Brew

Here is a dangerous cocktail: a) chronic dependency on either foreign aid, inbound remittances or resource rents (or all of the above) and b) a dangerously overvalued exchange rate that is (in most cases) artificially pegged to the all-mighty, yet inflated US dollar. One of the not-so-obvious consequences of this toxic brew is an accelerationContinue reading “Aid, Rents, Remittances and Pegs – A Toxic Brew”